Little Known Questions About How To Get Copy Of Bankruptcy Discharge Papers.

Everything about How Do I Get A Copy Of Bankruptcy Discharge Papers

Table of ContentsSome Known Details About Copy Of Chapter 7 Discharge Papers The Basic Principles Of How Do You Get A Copy Of Your Bankruptcy Discharge Papers What Does How To Get Copy Of Chapter 13 Discharge Papers Do?What Does Bankruptcy Discharge Paperwork Do?All about Copy Of Bankruptcy Discharge

Attorney's are not called for to keep bankruptcy filings. This does rely on each lawyer. The Discharge documents are complimentary if the personal bankruptcy discharged less than 30 schedule days from today if gotten on this site. "Free Bankruptcy Documents"A. All Firm and also Organization Data, might be bought by calling the united stateA. Personal bankruptcy documents utilize to be kept forever until 2015. Legislations have actually currently changed to keep bankruptcy apply for only two decades. This has actually caused a problem, with what is refereed to as "zombie" financial obligation. Check out the credit page. A. If you submit bankruptcy, It comes to be public record, as well as will be in the "public document" section of your credit rating report.

If you submitted insolvency in 2004 or prior, your records are limited, and also may not be readily available to get electronically. Telephone Call (800) 988-2448 to check the schedule prior to getting your records, if this applies to you. The records might be available with NARA.(a government company) We do not work in conjunction with NARA or any of its reps.

About Obtaining Copy Of Bankruptcy Discharge Papers

U.S. Records charge's to aid in the retrieval procedure of obtaining personal bankruptcy documentation from NARA, relies on the time engaged and cost entailed for united state Records, plus NARA's fees The Docket is a register of basic info throughout the bankruptcy. Such as standing, case number, filing and also discharges dates, Attorney & Trustee info.

If you're late paying the tax obligation, maintain the return 2 years from the date you paid or 3 from when you filed (whichever is later). When it concerns receipts, if there's a warranty, keep the invoice until the warranty runs out. Otherwise, for anything you could need to take back, simply maintain the invoice till the return duration is up.

Although your insolvency application, files, and also discharge appear like financial documents that could drop under the exact same timeline as your tax docs, they are NOT (how to obtain bankruptcy discharge letter). They are even more important as well as ought to be kept indefinitely. Lenders may return and try to gather on a debt that became part of the insolvency.

The Ultimate Guide To How Do I Get A Copy Of Bankruptcy Discharge Papers

Also, financial institutions offer off uncollectable bill in portions of thousands (or numerous thousands) of accounts. Uncollectable loan purchasers are typically hostile as well as deceitful, and having your personal bankruptcy files on-hand can be the fastest way to close them down and keep old things from popping back up on your credit score report.

Getting copies of your personal bankruptcy records from your legal representative can take time, especially if your instance is older as well as the copies are archived off-site. Obtaining bankruptcy records from the Federal courts can be pricey and also time-consuming.

Get a box or big envelope and placed them all within. Put them in a risk-free location, too like where you maintain your will certainly as well as other crucial economic papers as well as simply leave them there.

The Only Guide for How Do I Get A Copy Of Bankruptcy Discharge Papers

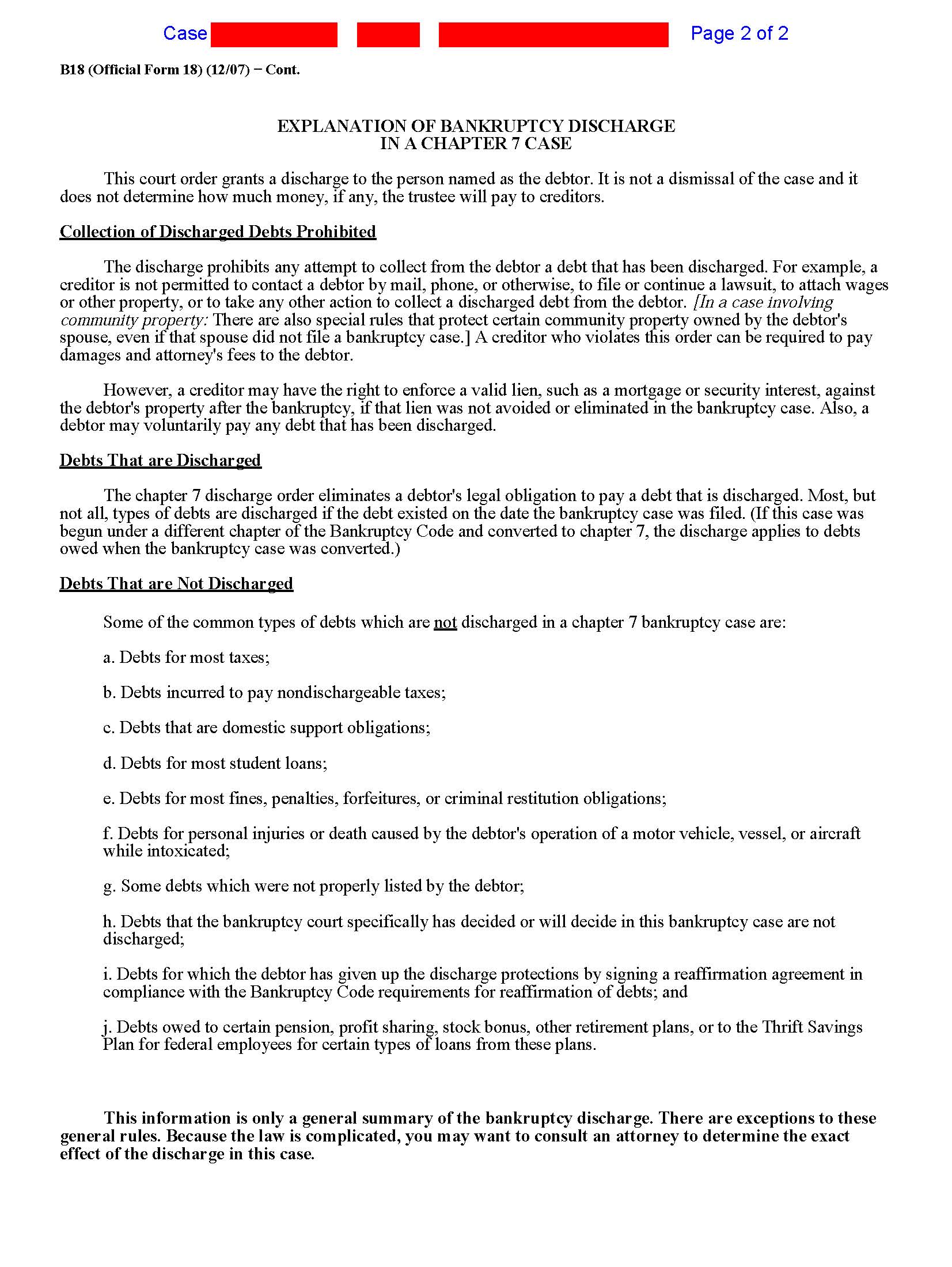

A released financial obligation literally disappears. It's no more collectible. The Recommended Site financial institution needs to write it off. Debts that are likely to be discharged in a bankruptcy case include debt card financial debts, clinical expenses, some suit judgments, personal car loans, responsibilities under a lease or other agreement, and also various other unprotected debts - https://www.techbookmarks.com/author/b4nkrvptcydcp/. That might appear as well good to be real, and there are indeed some disadvantages.

You can't merely ask the personal bankruptcy court to release your financial obligations due to the fact that you do not desire to pay them. You should complete all of the demands for your personal bankruptcy instance to receive a discharge.

Bankruptcy Trustee, and the trustee's lawyer. The trustee personally handles your personal bankruptcy case. This order includes notice that creditors ought to take no further activities to gather on the financial debts, or they'll face penalty for contempt. Maintain a duplicate of your order of discharge in addition to all your other bankruptcy paperwork.

How To Obtain Bankruptcy Discharge Letter Things To Know Before You Get This

You can submit a movement with the personal bankruptcy court to have your case reopened if any kind of lender attempts to accumulate a released financial debt from you. The creditor can be fined if the court identifies that it breached the discharge order. You can try merely sending out a duplicate of your order of discharge to stop any collection task, and also after that talk with a bankruptcy lawyer about taking lawful action if that doesn't function.

The trustee will liquidate your nonexempt properties and also split the proceeds among your creditors in a Chapter 7 bankruptcy. Any kind of financial debt that remains will certainly be discharged or eliminated. You'll participate in a settlement strategy over 3 to 5 years that repays all or a lot of your debts if you declare Phase 13 security.